insights

5 Common Ops Mistakes Brands Are Making in 2025 (+ How to Avoid Them)

Lakhveer Singh Jajj — Founder & CEO

How effectively brands manage their inventory in 2025 will shape who leads and who lags in the direct-to-consumer market. Teams that once relied on bulky spreadsheets and gut-check planning are now embracing smarter ways to manage their supply chains. But how exactly are they doing it?

We asked Mary Wiegand, Founder and CEO at Boon, a retail consultancy specializing in inventory optimization, what eCommerce brands are doing to simplify and scale their operations.

In this guide, we'll break down Mary's top strategies for solving today's operational challenges and the tools to unlock better forecasting and inventory planning for every merchant.

Why Smoother Ops are Your Most Important Growth Investment

Cost pressure, tariff unpredictability, and erratic demand are hitting margins hard. For scaling brands, smarter operations are just as critical as strong sales. However, without customizable, automated forecasting and replenishment tools, it's easy to fall behind.

"Inventory is the single biggest cost in most retail businesses," Mary explains. "But planning is often tacked onto someone's already full job description, and that's when reactive decisions start to snowball."

Mary has seen this firsthand across dozens of fast-growing brands. Her team has helped businesses double revenue, slash stockout times, and cut planning hours in half — all by building planning systems that anticipate change instead of reacting to it.

She notes that while tariffs and duties have always existed, today's volatility and lack of clarity around rates make proactive planning for landed costs, margins, and lead times more critical than ever. Brands that wait until the last minute to place orders often end up overpaying — or worse, understocked during key sales periods.

For example, one Boon client doubled annual revenue by shifting from reactive replenishment to forecast-aligned planning, using sales data and vendor lead times to plan more strategically and place orders earlier.

The bottom line: As Mary puts it, "When your number one expense isn't being proactively managed, it impacts profitability, slows growth, and frustrates your customers."

If you still rely on broad-stroke POs or static spreadsheets, now's the time to upgrade. Every delayed decision or misaligned buy chips away at your margins and ability to grow with confidence.

5 Operational Challenges Stalling eCommerce Brands — and How to Fix Them

Even the most forward-thinking brands run into bottlenecks as they grow. Here are five common operational challenges Mary sees across eCommerce businesses and how to solve them before your momentum takes a hit.

1. Forecast misalignment drains capital

When teams operate from different demand assumptions, execution slows and capital is misallocated. It's one of the most common (and costly) challenges Mary sees among scaling brands. "If sales is planning big, ops is ordering small, and finance is side-eying the whole thing from a cash flow spreadsheet — well, no one's going anywhere fast," she says.

Most teams still build plans in silos, forcing them to make and operate from different assumptions. This disconnect leads to reactive inventory buys, budget freezes, and unmet customer expectations.

And the impact is notable. According to the Harvard Business Review, stockouts spurred by poor forecasting cost retailers nearly $1 trillion globally every year and damage long-term customer loyalty.

The fix: Build a cross-functional forecast tied to real data inputs. In Mary's words, "your forecast should be the one plan everyone agrees on."

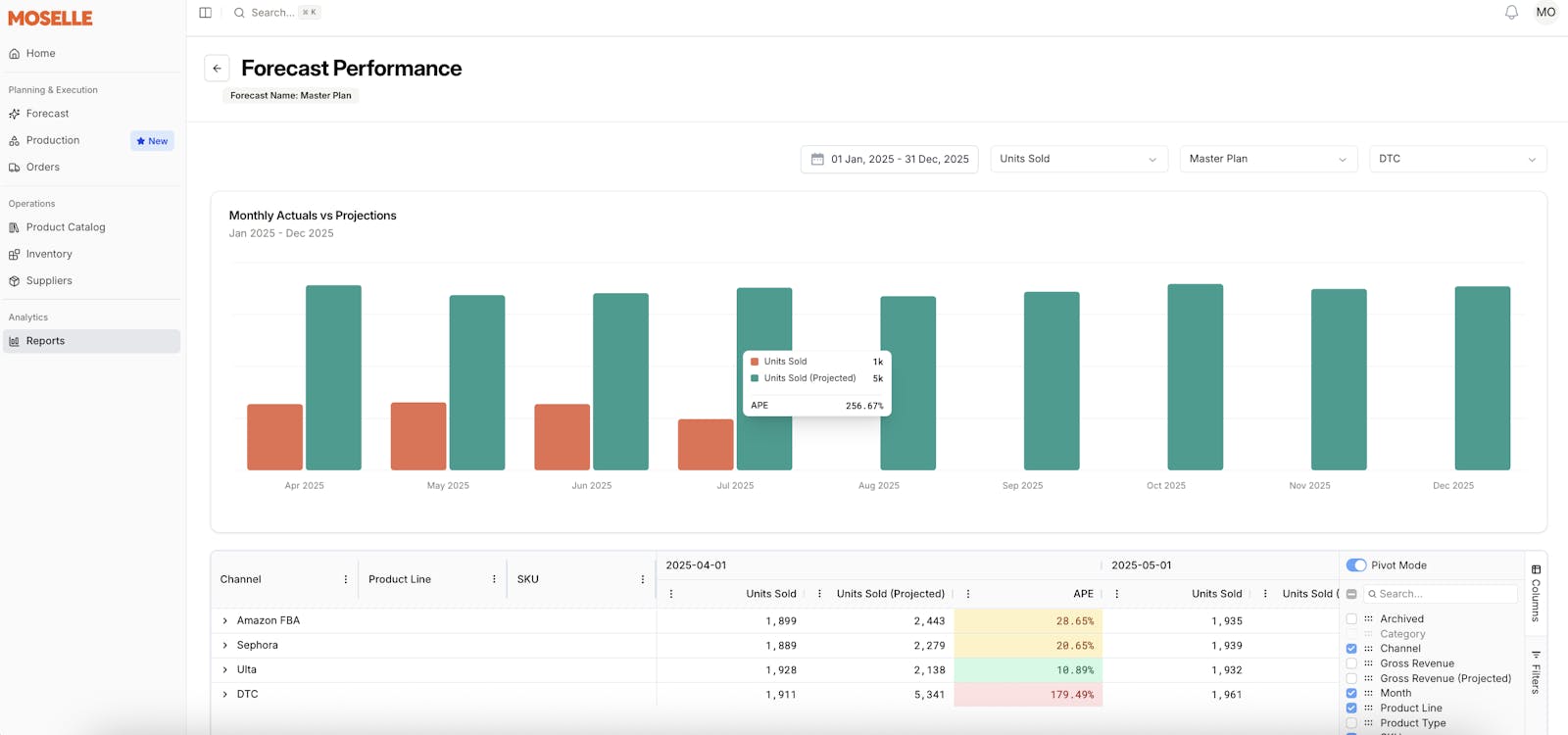

With a shared demand plan, teams move faster and stop working against each other. You avoid misfires that can cost thousands in excess inventory and wasted working capital. That's where an automated inventory platform like Moselle comes in. These tools help teams centralize forecasts and align across departments without chasing down spreadsheets or reconciling different versions of the truth.

2. Late replenishment puts your growth on pause

Brands that delay replenishment often miss key sales moments waiting for inventory to run low or sales to spike before placing new orders. But by then, the window's already closing. Teams with proactive systems in place can trigger buys earlier and keep momentum strong.

Mary sees it all the time: brands placing POs reactively, weeks after the data already showed demand climbing. By the time stock arrives, the window’s closed — and the customer's gone. "We've seen amazing brands lose hard-earned momentum simply because they couldn't keep their bestsellers in stock," she says.

Without a grounded demand plan, teams overindex on gut feeling, overorder slow movers, and miss rebuy windows for high performers. It's a cycle that drains cash and stalls growth.

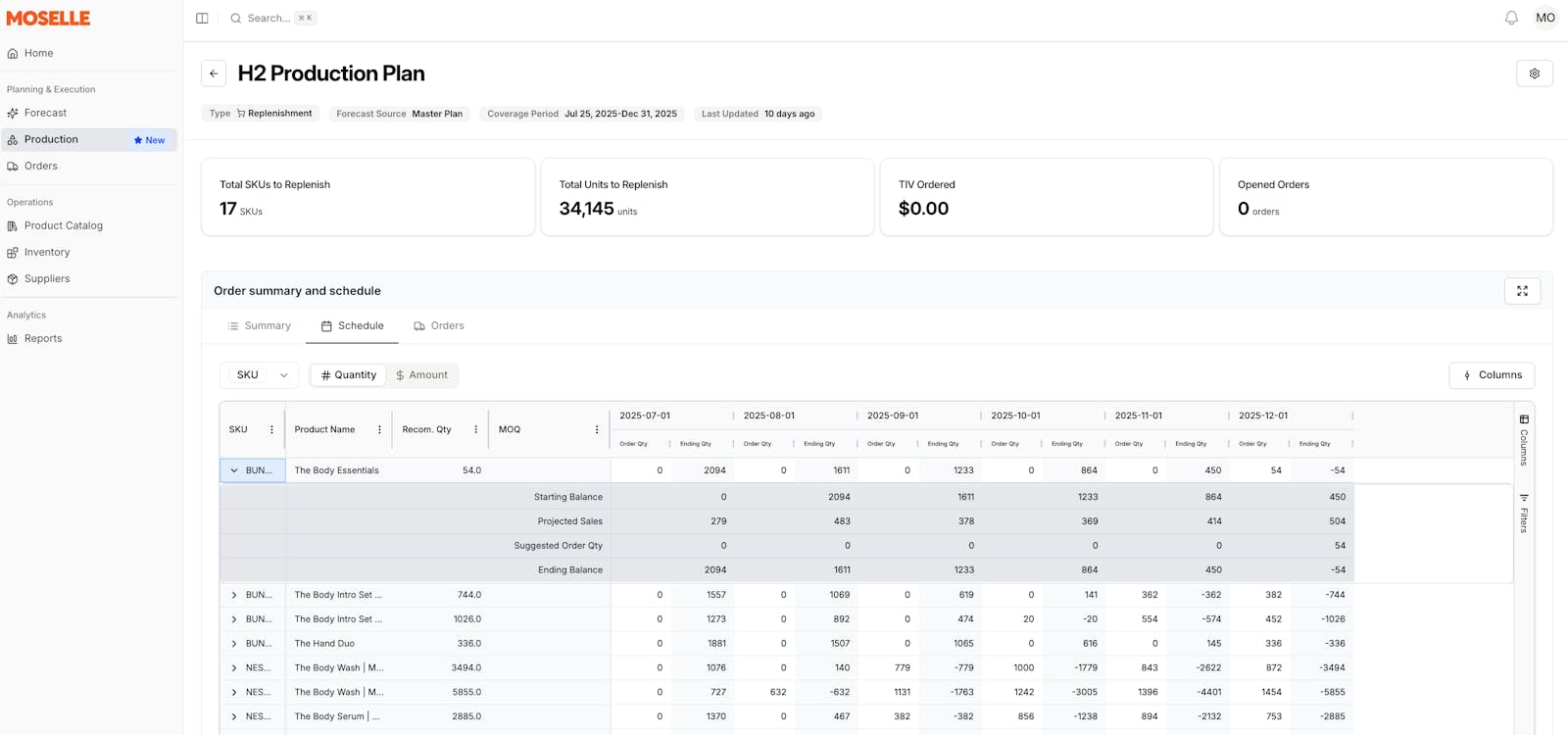

The fix: Use an open-to-buy (OTB) framework that accounts for vendor lead times, current stock, and upcoming demand to proactively trigger "buys" — Moselle's term for purchase orders auto-generated from forecasts. Timely replenishment drives consistent revenue and strengthens customer loyalty, especially for top-performing SKUs.

3. Tariff swings and duties quietly draining margins

Fluctuating tariffs and landed costs are some of the least understood (and most damaging) margin killers in operations today.

Mary explains that duties, freight rates, and port delays now change month to month, especially for Asia-based suppliers. Without visibility into shifting landed costs, "brands risk mispricing SKUs, missing margin targets, or even selling at a loss," she says. A single rate adjustment mid-shipment can wipe out projected profits and erode trust across finance and operations.

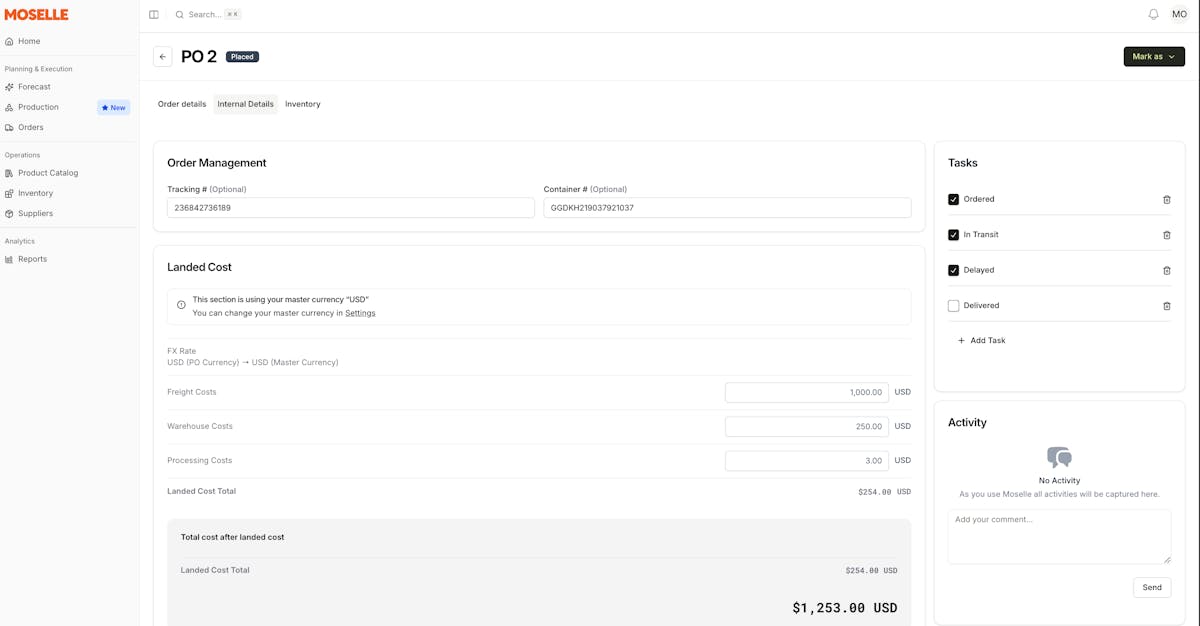

The fix: Diversify vendors, blend margin across SKUs, and map duties into your pricing models. Planning tools that incorporate inputs like supplier cost fluctuations or port delays help ensure your replenishment decisions reflect current conditions, not outdated assumptions.

Moselle makes this easy by allowing you to upload enrichment data like duty changes or freight delays directly into your forecasts, keeping your pricing and buying decisions aligned with real-world costs.

4. Big-picture metrics hide SKU-level mistakes

Without granular data, brands misread demand, hold dead stock, and miss their best sellers.

Mary notes that many brands rely heavily on topline metrics like sell-through or inventory value. However, that approach can bypass critical details, like which SKUs haven't sold in 60 days, or which items are outperforming expectations. When those signals are buried, teams miss key rebuy windows or let aging stock linger, locking up capital and triggering discounts that cut into profits.

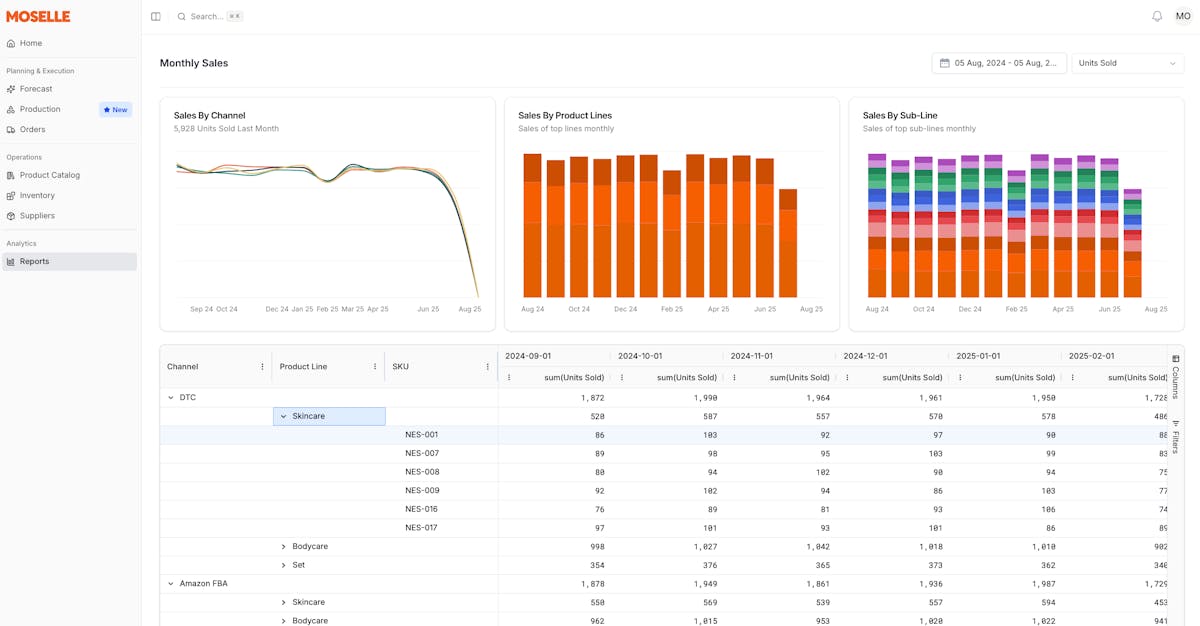

The fix: Track weeks of supply, in-stock percentage, AUR, and SKU-level velocity on a weekly basis. Don't just summarize — segment by category and lifecycle to get a clear picture of what's moving and what's not.

To spot both trends and outliers, high-performing brands rely on consistent, granular reporting — not topline dashboards or spreadsheet rollups. With Moselle, these insights come standard through automated reporting tools that highlight key patterns without the manual lift.

5. Tools aren't systems — and automation still needs ownership

Having dashboards isn't the same as having a planning process that drives results.

Many brands have a stack of BI tools, but no review cadence or decision framework. Without structure and accountability, automation just adds noise. Instead of making proactive adjustments, teams react to lagging indicators, which leads to late pivots and slower inventory movement. As Mary notes, without a regular review rhythm, "teams end up waiting for a quarterly post-mortem." By then, the opportunity to adjust has already passed.

The fix: Treat automation like a junior planner. It can surface the signals fast, but it's still your job to interpret them and act. Mary says many of Boon's clients have found success by running weekly or monthly sales performance reviews powered by automated dashboards. This regular cadence lets them catch issues early and make timely adjustments to avoid "fire drills" at quarter-end.

With Moselle, it's easy to build that review cadence into your workflow using Weekly and Monthly Rollups that give you a clear snapshot of performance — no spreadsheet crunching required.

Moselle Makes Expert-Level Planning Available to Every Retailer

Every fix in this guide, from aligning forecasts to tracking SKU-level performance, becomes easier and more reliable when supported by a flexible AI platform. Moselle brings this enterprise-grade inventory planning and forecasting to brands of all sizes, helping retailers automate the very strategies Mary recommends.

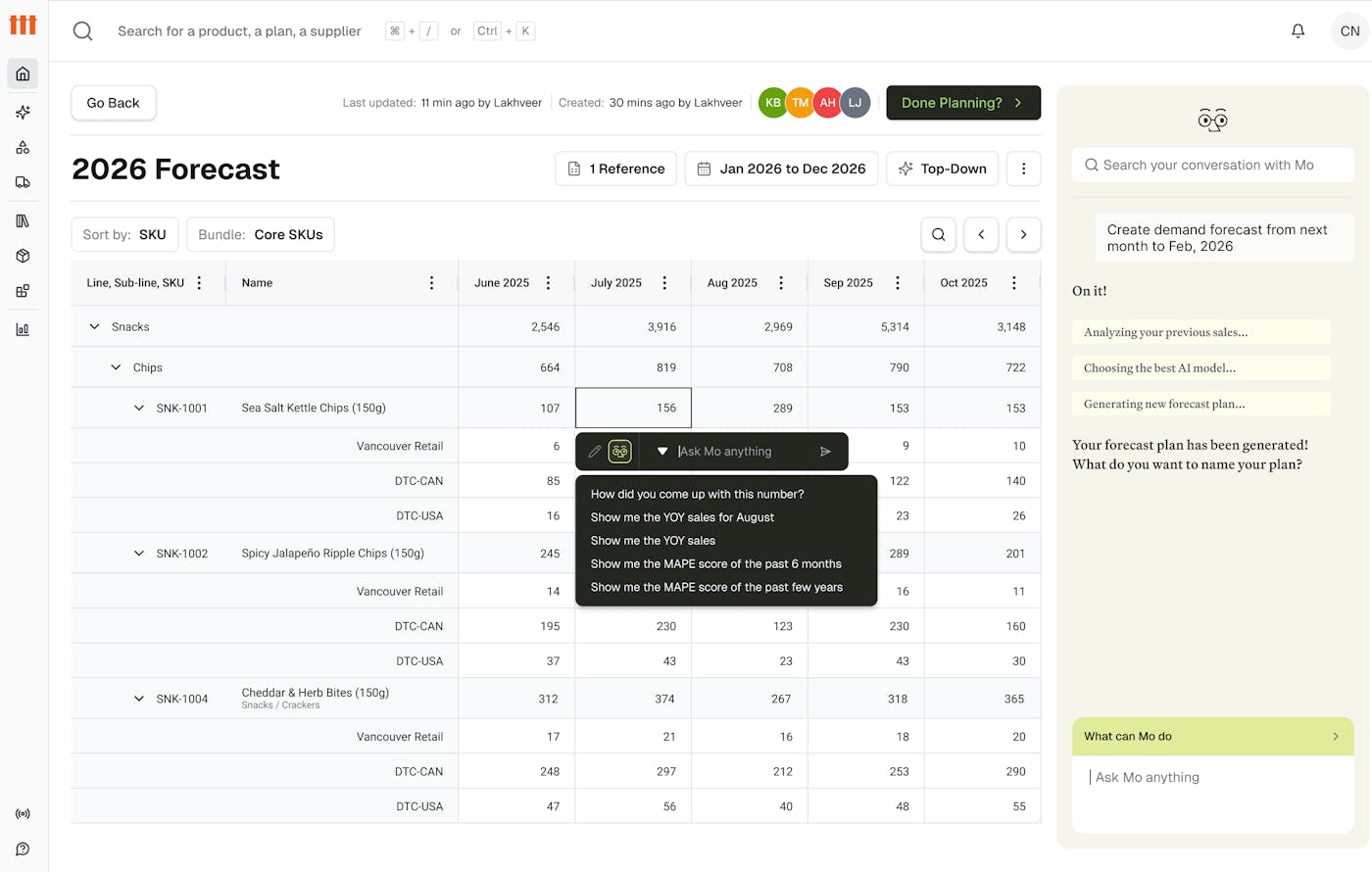

With Moselle, you can run both top-down and bottom-up forecasts for every SKU and channel, updated daily using real sales data. Every forecast is customizable, so you can override projections using your unique business rules, adjust for lead times, or apply your own catalog structure. It's fully adaptable to your workflows.

Once your plan is in place, Moselle makes execution seamless. Generate replenishment plans that tie together runway, stock levels, vendor lead times, and safety stock — then convert them into "buys" (purchase orders) with one click. Built-in Weekly and Monthly Rollups track SKU-level velocity and inventory value automatically, giving you clear, real-time visibility without the manual lift.

Need to adjust for variables like promos or supplier shifts? Moselle makes it easy to upload enrichment data that fine-tunes your forecast logic, keeping your plans dynamic and grounded in context.

And now, with Mo — your AI-powered planning companion — you can move even faster. Mo answers complex forecasting questions in plain language, offers tailored recommendations, and explains its logic with full transparency. Whether you're prepping for peak season or spotting a sudden drop in sales for a core SKU, Mo helps your team act with speed and clarity — no added headcount required.

Just ask Doré. The French pharmacy-inspired beauty brand used Moselle to streamline forecasting across three warehouses, reduce excess inventory, and cut manual reporting time by 70%. "Moselle lets us move quickly and make better decisions," says co-founder Emily Yeston.

With Mo in the mix, teams like Doré's can now troubleshoot faster and fine-tune forecasts in seconds — unlocking more margin with every decision.

Smarter Inventory Planning Starts Here

Moselle helps you stay agile and accurate with 80% more accurate forecasts, 16% fewer stockouts, and over 15 hours saved each week on inventory planning. You'll make smarter decisions faster, without the guesswork.

Get started with Moselle or chat with the team at Boon to bring proactive inventory planning to your team.